Title

Selecting the Right Accounts Payable (AP) Automation Software for Your Business

In today’s fast-paced business environment, organisations are increasingly turning to automation to streamline operations and improve efficiency. One area where automation is making a significant impact is Accounts Payable (AP). By automating AP processes, businesses can reduce manual errors, improve supplier relationships, and gain better control over cash flow.

However, with a myriad of AP automation solutions available in the market, selecting the right one for your business can be a daunting task. This guide outlines key considerations to help you make an informed decision, with insights into how Esker’s innovative solutions can support your journey.

Understanding Accounts Payable (AP) Automation Software

AP automation software is designed to digitise and automate the entire accounts payable process, from invoice capture to payment processing. By leveraging features like AI-driven data extraction, approval workflows, and integration with existing systems, AP automation tools eliminate manual data entry, minimise errors, and accelerate payment cycles. The right solution can transform your AP department into a strategic asset.

Esker’s AP automation solution stands out for its advanced AI-driven capabilities, seamless ERP integration, and robust reporting tools. With Esker, businesses gain real-time visibility and control over their AP processes, enabling them to improve cash flow, reduce processing costs, and enhance supplier relationships. This comprehensive approach positions Esker as a trusted partner in driving efficiency and compliance.

Key features to look for

When evaluating AP Automation Software, prioritise the following features:

Seamless Integration

Ensure the software integrates easily with your existing ERP, accounting software, or other financial systems. Integration minimises disruptions and allows for a smoother transition. Integrating with any ERP system and providing simutaneous integration with multiple ERPs. Esker’s accounts payable system can handle as many enterprise resource planning (ERPs) as needed within one single environment. This type of unified cloud platform means all users work in the same experience, whether you’re using one ERP or multiple systems.

Intelligent Data Capture

Look for AI-driven tools that can accurately extract data from invoices, regardless of format (PDF, scanned documents, emails). Esker Synergy AI optimises invoice data extraction by using machine learning and deep learning to accurately extract and populate into a validation form (or auto-approved when no exception is detected).

Compliance and Security

Select a solution that ensures compliance with regional regulations, such as e-invoicing mandates, and prioritises data security. Esker’s AP solution delivers compliant, paperless invoice processing on a global scale. Archived invoices are kept secure for as long as the local laws dictate. Esker's platform is built on the highest level of safety and security standards. But we prefer to let our record of compliance and certifications speak for itself.

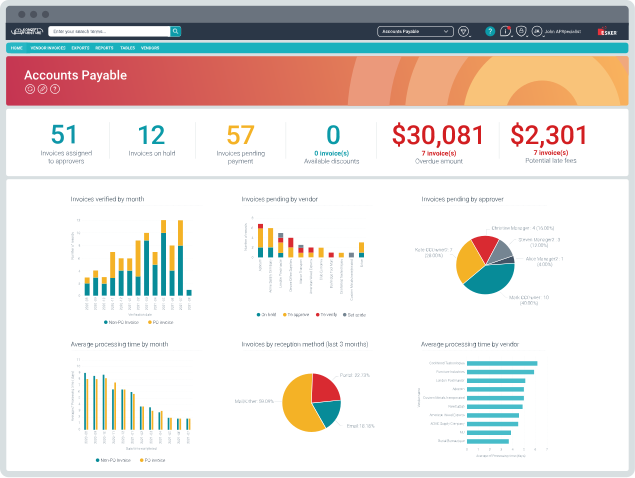

Reporting and Analytics

Robust reporting features provide insights into payment trends, supplier performance, and cash flow, enabling data-driven decision-making. Esker’s comprehensive dashboard allows users to track KPIs and identify bottlenecks with ease.

Scalability

As your business grows, your AP automation software should be able to scale with your needs, accommodating increased invoice volumes without compromising performance.

Mobile Accessibility

In today’s remote work environment, mobile-friendly solutions enable users to approve invoices and monitor payments on the go. Esker’s Anywhere Mobile App enables users to approve invoices and monitor payments on the go. This ensures continuity and efficiency even for teams working across multiple locations.

Assessing Your Business Needs

Before diving into the selection process, conduct an internal assessment to identify your specific needs:

- Volume of Invoices: Determine the number of invoices processed monthly to identify a solution that can handle your current and projected workload.

- Pain Points: Highlight challenges such as slow approval cycles, frequent errors, or lack of visibility. Choose a tool that addresses these pain points effectively. For example, Esker’s AP solution reduces approval times by up to 65% and provides enhanced visibility at every stage.

- Budget: Set a realistic budget for the software, including implementation and ongoing costs. Remember that the right solution will deliver long-term ROI.

- Stakeholder Requirements: Engage AP staff, finance teams, and IT departments to understand their priorities and must-have features.

Case Study: Sunway Success Story

Sunway Group Southeast Asia's leading conglomerates struggled with manual invoice processing, leading to:

- Data entry errors.

- Missing documents.

- Slow invoice processing times.

- Stressed-out staff.

A lot of time was spent on replying to questions from suppliers about invoice status and chasing after payments. By implementing Esker’s AP automation solution, the company achieved:

- 50% faster processing time Increased AP team efficiency

- Higher-value & analytical work performed

- 100% visibility over AP processes

- Reduced 40% of office filing space

- Accelerated approval times

- Enhanced collaboration Improved communications with vendors

Implementation Considerations

Even the best AP automation software won’t deliver results if the implementation is poorly managed. Keep the following in mind:

- Implementation Timeline: Work with the vendor to establish a realistic timeline, ensuring minimal disruption to your operations.

- Training and Onboarding: Provide thorough training for your team to ensure they understand how to use the new system effectively.

- Data Migration: Plan for seamless data migration from your existing systems to the new software, avoiding loss or duplication of data.

- Feedback Loop: During the initial stages, gather feedback from users to identify any issues or areas for improvement.

Measuring Success

After implementing your chosen AP automation software, monitor its performance against the following KPIs:

- Invoice Processing Time: Measure the time taken from invoice receipt to payment completion.

- Error Reduction: Track the frequency of errors before and after automation.

- Cost Savings: Evaluate the reduction in operational costs, including savings from decreased manual labor and paper usage

- User Adoption: Assess how much time your finance team spends on value-added tasks versus manual data entry.

- Supplier Satisfaction: Evaluate improvements in supplier relationships due to faster payments and improved communication.

Conclusion

Selecting the right AP automation software is a strategic decision that can yield significant benefits for your business. By identifying your needs, prioritising key features, and carefully evaluating vendors, you can implement a solution that streamlines your AP processes, enhances efficiency, and supports your long-term growth. With Esker’s advanced automation tools, backed by real-world success stories and actionable insights, your AP department can transition from a cost center to a value-driving contributor to your organisation’s success. Ready to take the next step? Contact Esker today to learn more.